For the past few years, the housing market has been stuck in a bit of a freeze. High mortgage rates have made homeowners who locked in lower rates hesitant to sell, leading to fewer homes on the market and less activity overall. However, this could be changing soon. As mortgage rates begin to drop, new analysis suggests that certain metro areas may see an increase in seller and refinance activity, signaling a potential thaw in the housing market.

Why the Market Has Been Frozen

The main reason for the slowdown in the housing market has been high mortgage rates. Many homeowners who bought their homes when rates were lower have been reluctant to sell and take on a new mortgage with a higher rate. This “lock-in” effect has kept many homes off the market, limiting options for potential buyers and slowing down market activity.

The Signs of a Thaw

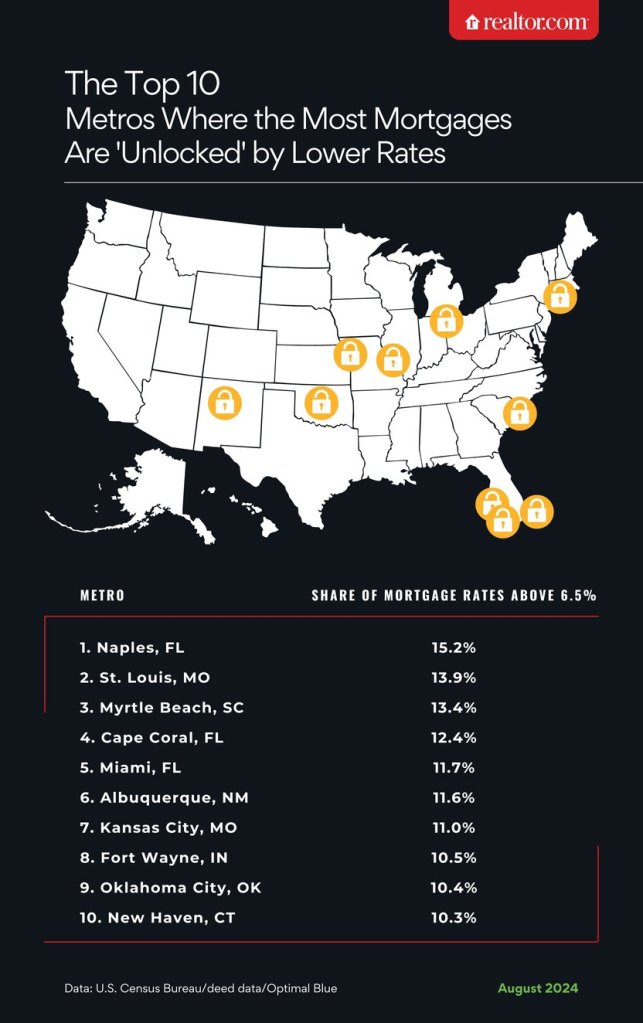

According to a new analysis from Realtor.com, certain metro areas could see early signs of increased market activity as rates continue to fall. These markets have a high percentage of recent home sales when rates were above 6.5%. Homeowners in these areas are now “unlocked” and in a better position to refinance or sell their homes as rates dip below this threshold.

Naples, FL leads the list, with 15.2% of mortgages estimated to be above the 6.5% cutoff, compared to a national average of just 5.3%. Other cities on the list include St. Louis, MO (13.9%), Myrtle Beach, SC (13.4%), Cape Coral, FL (12.4%), and Miami, FL (11.7%). These areas could be among the first to benefit from falling rates, as homeowners look to refinance or sell.

What’s Next for the Housing Market?

The Realtor.com economic research team projects that mortgage rates will continue to fall, potentially reaching 6.3% by the end of this year. If this happens, the identified cities could see a significant increase in market activity as more homeowners feel financially comfortable selling or refinancing.

“From this point forward, assuming rates continue to ease, selling or refinancing may look increasingly attractive to many homeowners in these markets,” says Realtor.com senior data analyst Hannah Jones.

However, it’s worth noting that the marginal benefit of selling might still be too small for some recent buyers, especially if they have only recently purchased their homes at higher rates. In these cases, refinancing may be a more appealing option.

The Cities with the Highest Share of ‘Unlocked’ Mortgages

The cities identified by Realtor.com have seen significant recent population growth and home price increases. For instance, home prices in Naples, FL, have grown 69% from 2020 to 2023. As rates fall, these markets may return to a more balanced state between buyers and sellers.

Cities like Fort Wayne, IN, Albuquerque, NM, Kansas City, MO, and New Haven, CT also made the list. These areas are diverse in terms of geography and affordability, and each has a high share of owner-occupied homes with mortgages above the 6.5% threshold.

The Path to a Balanced Market

As mortgage rates continue to decrease, the housing markets in these cities are moving back toward balance. In July, inventory climbed annually in each of these markets, which could spur further sales despite still-high mortgage rates. Buyers in these markets currently enjoy a variety of home options and can potentially take advantage of falling rates.

For homeowners feeling “locked in” by high mortgage rates, the easing of rates could provide new opportunities. Whether choosing to sell or refinance, it’s essential to keep an eye on market trends and make informed decisions based on current conditions.

As mortgage rates begin to fall, there are clear signs that the housing market may be warming up in certain metro areas. If you’re a homeowner or a prospective buyer, now is a great time to stay informed about these changes. Keep an eye on market trends in your area, and consider consulting with a real estate professional to explore your options.