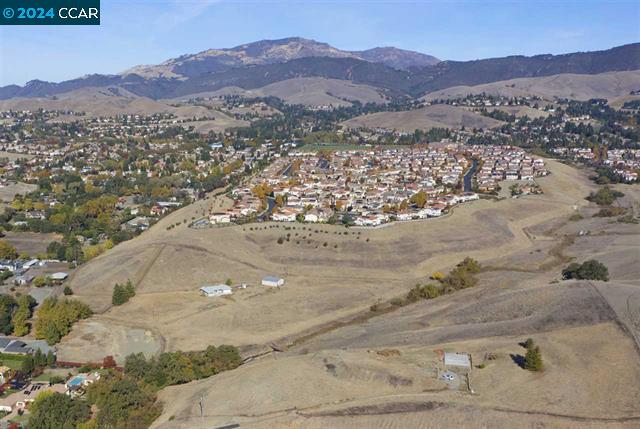

In the suburb of Orinda, California, just outside of San Francisco, Rana Robillard’s dream of homeownership turned into a nightmare. A 25-year veteran of tech companies, including a cybersecurity firm, Robillard fell victim to a sophisticated wire fraud scam that cost her nearly $400,000—the entirety of her life savings.

A Dream Home and a Devastating Fraud

After a yearlong search, Robillard was thrilled to learn she had beaten three other bidders for a house in Orinda. As the closing date approached, she received an email from her mortgage broker with instructions to wire the $398,359.58 down payment to a JPMorgan Chase account. The email appeared to be a response to one she had sent asking about final steps, so she promptly wired the money.

The following day, she received a duplicate request for the down payment, and the horrifying realization dawned on her: she had been scammed. Instead of sending her down payment to the title company, she had sent her life savings to a criminal.

The Increasing Sophistication of Cybercrime

Robillard’s experience is a stark reminder of the increasingly sophisticated nature of cybercrime. Fraudsters are now capable of penetrating the email systems of mortgage brokers, real estate agents, lawyers, and other advisors. They wait for the perfect moment to strike, sending emails or making phone calls that appear to be from trusted parties.

Real estate transactions, with their large sums and frequent use of wire transfers, have become especially lucrative targets for criminals. Wire transfers are fast, typically closing within 24 hours, can handle large sums, and are often irreversible—ideal conditions for fraud.

According to the FBI, scams involving fake emails in real estate deals have surged over the last decade, with losses skyrocketing from less than $9 million in 2015 to $446.1 million by 2022.

The Aftermath and the Struggle for Recovery

Immediately after realizing the fraud, Robillard alerted her bank, Charles Schwab, and the FBI. Within days, the FBI located and froze the funds. Despite this initial success, the process of recovering the money proved to be long and frustrating. Robillard was told her funds would likely be released after 90 days, but months passed with few updates from JPMorgan, which took the lead on the case.

Robillard took matters into her own hands, advocating for herself by reaching out to elected officials, government agencies, and even random people on LinkedIn from Chase. Despite her relentless efforts, she found little help.

A Breakthrough and Lessons Learned

After more than five months of uncertainty, Robillard finally caught a break. A few days after CNBC contacted the banks involved, she received $150,000 from Chase, followed by nearly $250,000 from Citi. JPMorgan expressed regret for the incident and advised consumers to be wary of last-minute changes to payment instructions and to verify wire recipients before sending money.

While relieved to have her funds returned, Robillard’s experience highlights the need for better security measures in real estate transactions. She acknowledges that she could have been more cautious and confirmed the wire request’s authenticity with the title company. She also points out that her real estate agent should have explained that wire directions would come directly from the title company, and her mortgage broker should have used a secure portal for document sharing.

The Future of Cybercrime in Real Estate

Robillard’s story underscores the urgency for the real estate industry to enhance its security protocols. The increasing reliance on electronic transactions makes buyers more vulnerable to fraud. Advances in artificial intelligence will provide criminals with more tools to impersonate trusted parties and steal money.

“The banks and real estate companies weren’t even prepared for the old world; how are they going to handle the new one?” Robillard warns. “Nobody’s ready for what’s coming.”

As she begins her search for a new home, Robillard is determined to raise awareness about real estate wire fraud. Despite the painful experience, she hopes her story will prevent others from falling victim to similar scams.

Rana Robillard’s ordeal is a powerful reminder of the need for vigilance in real estate transactions. As cybercrime becomes more sophisticated, it is crucial for all parties involved to implement stringent security measures. By sharing her story, Robillard aims to protect others from the devastating impact of wire fraud and push for necessary changes in the industry.

Stay vigilant, verify every transaction, and advocate for stronger protections—these are the lessons we must take from Robillard’s experience.

https://www.cnbc.com/2024/07/23/wire-fraud-in-real-estate-silicon-valley-executive-warning.html

If you’re considering a move or investment and require a trusted Real Estate Broker, we’re here to assist you. Contact us via email at TEAM@McDanielCallahan.com, complete the form below, or give us a call at 925-838-4300. We are ready to provide expert guidance and support for all your real estate needs. Terry McDaniel DRE License #00941526