When you think of luxury real estate hotspots in the U.S., you might immediately picture sprawling estates in Los Angeles or high-rise penthouses in Manhattan. However, this fall, the best luxury markets for sellers aren’t necessarily the ones with sky-high prices. Instead, they’re in more affordable regions of the Midwest and Northeast. These areas offer luxury sellers a unique advantage due to strong demand for high-end homes, even if the price points are lower than in traditional luxury markets.

St. Louis: An Unexpected Luxury Haven

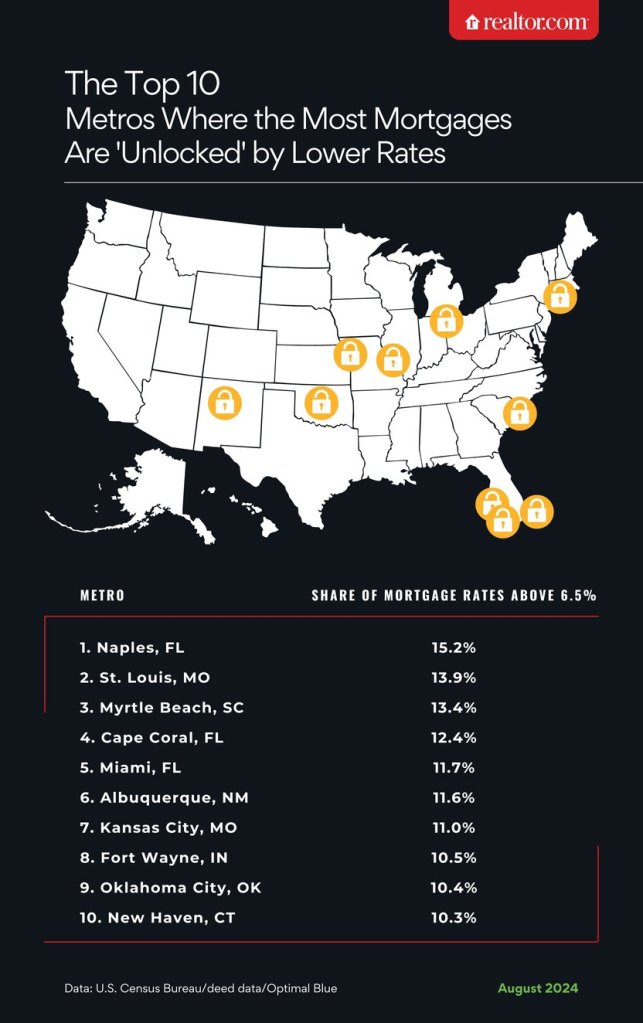

St. Louis may not be the first place that comes to mind when you think of luxury real estate, but this market is proving to be a strong contender. With luxury median listing prices up nearly 8% annually in the second quarter, there is a clear demand for upscale properties. Unlike the high-pressure markets on the coasts, St. Louis offers luxury buyers more affordable options without sacrificing amenities.

Homes that feature modern upgrades, such as new kitchens and pools, are moving quickly in St. Louis. The city’s affordability, coupled with a desire for quality living spaces, is attracting buyers from various parts of the country. As a result, luxury sellers in St. Louis have a significant advantage, especially with a limited inventory that keeps the market competitive. If you’re considering selling your luxury home in St. Louis, now might be the perfect time to capitalize on this market trend.

Portland, Maine: A Luxury Market on the Rise

Portland, Maine, has become a magnet for luxury buyers seeking a blend of affordability and exclusivity. The luxury median listing price in Portland has risen by nearly 14% over the past year, reflecting a growing interest in the area. Many buyers are coming from larger cities like Boston and New York, drawn by the promise of a more relaxed lifestyle without completely severing ties with major urban centers.

One interesting trend in Portland is the influence of climate migration. Buyers are looking for locations with more predictable and stable weather, and Portland fits the bill. This shift is likely to continue, making Portland an attractive market for luxury sellers. However, real estate agents caution that the market isn’t as frenzied as it was during the peak of the pandemic. Sellers should be mindful of pricing their homes appropriately and ensuring that they are well-prepared before listing.

Detroit: A Market for Unique Luxury Homes

Detroit’s luxury market is quite distinct, characterized by historic homes and unique properties that appeal to a specific segment of buyers. The luxury median listing price in the Detroit metro area is just under $800,000, offering tremendous value compared to other cities where similar homes might cost significantly more.

One of the challenges for luxury sellers in Detroit is the limited supply of homes, which can drive up interest in properties that do become available. Buyers in Detroit are often looking for something specific, such as historic charm or newly built luxury houses in certain neighborhoods. For sellers, this means understanding what makes their property unique and marketing it to the right buyers.

Agents in Detroit recommend having a plan in place for your next move, especially if you plan to stay in the area. Knowing where you’ll go after selling your luxury home can make the process much smoother and more stress-free.

Tips for Luxury Sellers in Affordable Markets

If you’re considering selling a luxury home in one of these affordable markets, here are a few tips to help you make the most of the current conditions:

- Understand Your Market: Research the specific demands of luxury buyers in your area. Are they looking for modern amenities, historic charm, or proximity to certain features like downtown areas or schools?

- Price Appropriately: Even in a seller’s market, overpricing can turn away potential buyers. Work with a local real estate agent who understands the nuances of pricing luxury homes in your market.

- Prepare Your Home: Luxury buyers expect high standards. Ensure your home is in top condition, with all necessary repairs and updates completed before listing.

- Market Strategically: Use high-quality photos and consider virtual tours to showcase your home’s best features. Highlight what makes your property unique in the market.

- Be Ready for a Quick Sale: In hot markets, homes can sell fast. Have a plan for your next steps, whether it’s moving to a new home or renting temporarily.

The luxury real estate market is evolving, with new hotspots emerging in more affordable areas of the Midwest and Northeast. If you’re a luxury homeowner in cities like St. Louis, Portland, or Detroit, this fall presents a unique opportunity to capitalize on strong demand and favorable market conditions. With careful planning and strategic preparation, you can make the most of this moment and achieve a successful sale.

By staying informed about market trends and understanding the specific needs of luxury buyers, you can navigate this dynamic market with confidence. Whether you’re looking to sell now or considering it in the near future, keeping an eye on these emerging luxury markets could be your key to success.

If you’re considering a move or investment and require a trusted Real Estate Broker, we’re here to assist you. Contact us via email at TEAM@McDanielCallahan.com, complete the form below, or give us a call at 925-838-4300. We are ready to provide expert guidance and support for all your real estate needs. Terry McDaniel DRE License #00941526